Explore web search results related to this domain and discover relevant information.

In January, I went into a dealership to buy a car. I walked in pre-approved through capital one. As I was going through the process, the dealership…

For credit scoring models, i.e. FICO, multiple inquiries on the same day for the same purpose (auto loan) are grouped together. Simply put, 14 car loan inquiries on the same day impact your credit score in the same way as 1 inquiry would have.The comments telling you 1 inquiry scores the same as 14 are correct. If you have multiple hard pulls for an auto loan they will only count as 1 against your credit score, however your report will show all of them. To put it into numbers, lets pretend you have a credit score of 700 and an auto loan inquiry drops your score by 5 points.Your score is now 695 regardless of the amount of hard pulls for an auto loan you get. Your score will NOT drop to 630(700-(14x5)) or any other number. You did mention you have had "4 more inquiries since then". Those 4 may impact your credit score assuming they are for different products.Although your credit is high enough for a mortgage, so just go for it & keep improving your score! ... I'm impressed with how many times they ran it. I usually get 4-8 inquiries max, and it's still relatively on the low end. ... All those inquiries are scored as one though. ... I'm not sure what your point is. Yes, those 14 separate hard inquiries are showing up separately on their credit report, but FICO is scoring them as just one since they were all done together as part of the loan shopping process.

Un porte-parole du groupe a précisé qu’il s’agissait d’un bug au niveau de l’acceptation des paiements des porteurs de cartes Crédit Mutuel, CIC et Monabanq, un bug qui « n’est pas inédit » dans le monde bancaire même si c’est la première fois qu’il affectait le groupe aux 14 ...

Un porte-parole du groupe a précisé qu’il s’agissait d’un bug au niveau de l’acceptation des paiements des porteurs de cartes Crédit Mutuel, CIC et Monabanq, un bug qui « n’est pas inédit » dans le monde bancaire même si c’est la première fois qu’il affectait le groupe aux 14 millions de clients.Une vaste panne a affecté les services informatiques du Crédit Mutuel, empêchant les clients du groupe bancaire de payer ou de retirer de l’argent pendant deux heures samedi, un « dysfonctionnement interne », selon la banque.« Un dysfonctionnement interne a empêché ce jour entre 17 h 20 et 19 h 30, les paiements et retraits par carte bancaire des sociétaires et clients de 16 fédérations du Crédit Mutuel », a indiqué le Crédit Mutuel sur le réseau social X samedi 30 août 2025.Laurent Berger, ancien secrétaire général de la CFDT, rejoint le Crédit mutuel (12/09/2023)

CRediT is a community-owned 14 role taxonomy that can be used to describe the key types of contributions typically made to the production and publication of research output such as research articles.

Welcome to the website and resource hub for the Contributor Role Taxonomy (CRediT).Here you can discover the origins of CRediT, find out how the taxonomy is being used, and access a range of resources to help you consider its value and potential uses.In 2022 CRediT was approved as an ANSI/NISO standard; CRediT is licensed for permissive re-use (Creative Commons 4.0 (CC-BY)).CRediT descriptors are now available in a range of languages, see CRediT language translations.

Error. Your credit card has not been charged. The [14] Card No. error code means that the credit card number was entered incorrectly.

Error. Your credit card has not been charged. The [14] Card No. error code means that the credit card number was entered incorrectly.I'm trying to pay, but I keep receiving this message: Our credit card processor encountered the following error: [14] Card No.To fix this issue, re-submit your credit card or use a different credit card.For more information about common error codes, see the article: Resolving issues when your credit card fails.

Où trouver un distributeur de billets CREDIT INDUSTRIEL DE L OUEST proche de 14 RUE DE LA BARILLERIE NANTES, PAYS DE LA LOIRE 44000

Les distributeurs automatiques de billets (DAB) CREDIT INDUSTRIEL DE L OUEST situés à Reze offrent fréquemment des billets de différentes coupures, allant des billets de 10 euros jusqu'aux billets de 500 euros. Néanmoins, la disponibilité des billets de différentes coupures peut varier en fonction de l'établissement et de la banque qui contrôle le DAB CREDIT INDUSTRIEL DE L OUEST.Après avoir saisi toutes les instructions nécessaires, vous pourrez retirer de l'argent en confirmant sur le bouton adéquat sur l'écran du DAB. Le DAB CREDIT INDUSTRIEL DE L OUEST vous remettra alors les billets que vous sollicités et imprimera un reçu pour votre transaction.Il est préconisé de retirer de l'argent dans un DAB installé dans une banque CREDIT INDUSTRIEL DE L OUEST ou un lieu bien éclairé et fréquenté pour éviter les risques de fraude.Une fois que vous avez retrouvé un DAB CREDIT INDUSTRIEL DE L OUEST, vous devrez introduire votre carte bleu dans la fente prévue à cet effet et saisir votre code secret.

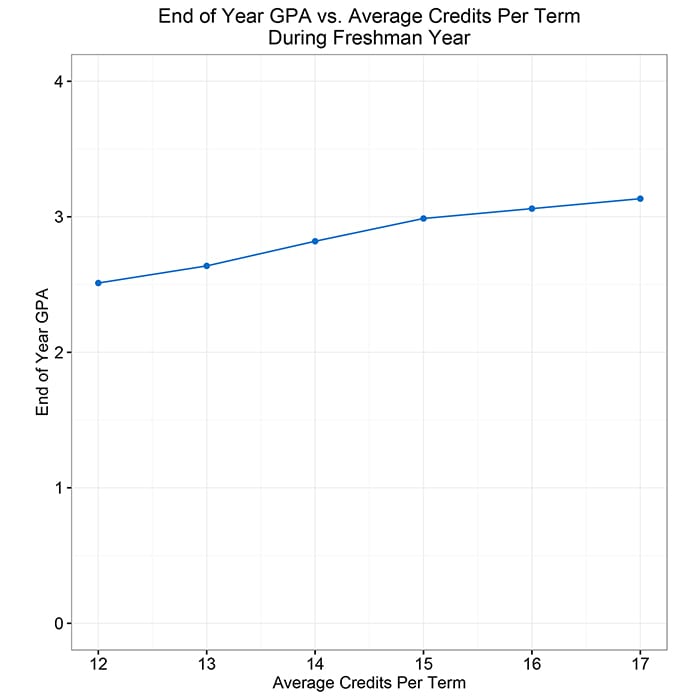

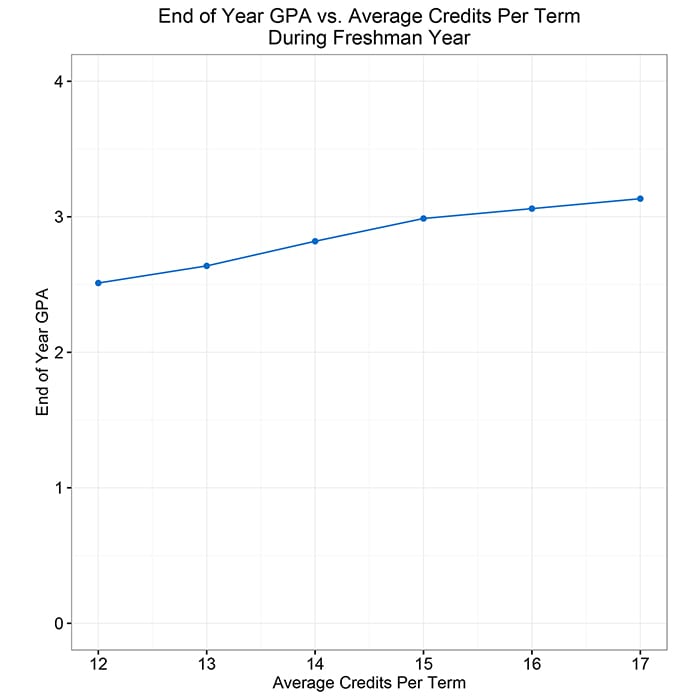

I often hear from advisors and ... life—and many students think the same way. As a result, 44% of incoming full-time students average just 12-14 credits per term during their first year, less than the 15 they need to stay on pace for four-year graduation....

I often hear from advisors and administrators the desire to protect their new students from overwhelming themselves with coursework in their first year, especially if it seems like the student would benefit from the chance to adjust to college life—and many students think the same way. As a result, 44% of incoming full-time students average just 12-14 credits per term during their first year, less than the 15 they need to stay on pace for four-year graduation.Analysis of historical records verified that incoming students of all backgrounds and academic achievement levels performed just as well on average when taking a 15 credit course load. Since the “15 to Finish” philosophy is becoming much more widespread, we sought a national analysis to see if the findings from UH held true for other students and schools. We examined data from 1.3 million incoming full-time students representing 137 schools in the Student Success Collaborative and compared outcomes for students who averaged 12-14 credits per term across the first year to those averaging 15 or more.We found that students of every level of high school academic achievement experienced better first-year GPA and retention outcomes when they took more courses. Even students with a high school GPA between 2.0 and 3.0, who averaged at least 15 credits, were two percentage points more likely to persist than their peers that only took 12-14 credits.Using the Pell grant as a proxy for family income, we found that Pell students who took 15+ credits were seven percentage points more likely to persist and had an end-of-year GPA that was 0.12 points higher than their Pell recipient peers who averaged only 12-14 credits per term in the first year.

This is going to be my first year in college and I’ll be a full time student. I’m taking english, integrated reading/writing, chemistry lecture&lab, and biology lecture&lab. Is 14 hours too much for me? or is it normal to have 14 credit hours?

This is going to be my first year in college and I’ll be a full time student. I’m taking english, integrated reading/writing, chemistry lecture&lab, and biology lecture&lab. Is 14 hours too much for me? or is it normal t…

Each credit hour corresponds to a minimum of 3 hours of student engagement per week for a traditional 14-week course or 6 hours per week for a 7-week course.

Wondering how all those credit hours add up? AIC abides by the standard Carnegie Unit to calculate credit hours for all traditional and distance courses.AIC uses the industry-standard Carnegie Unit to define credit hours for both traditional and distance courses.American International College

Added by Laws 1969, c. 352, § 2-109, eff. July 1, 1969. Amended by Laws 1982, c. 335, § 10, operative June 1, 1982 · Disclaimer: These codes may not be the most recent version. Oklahoma may have more current or accurate information. We make no warranties or guarantees about the accuracy, ...

14A OK Stat § 14A-2-109. Definition: (2014) What's This? "Credit service charge" means a finance charge composed of the sum of ·(1) all charges payable directly or indirectly by the buyer and imposed directly or indirectly by the seller as an incident to the extension of credit, including any of the following types of charges which are applicable: time price differential, service, carrying or other charge, however denominated, premium or other charge for any guarantee or insurance protecting the seller against the buyer's default or other credit loss; and(2) charges incurred for investigating the collateral or credit worthiness of the buyer or for commissions or brokerage for obtaining the credit, irrespective of the person to whom the charges are paid or payable, unless the seller had no notice of the charges when the credit was granted.

I often hear from advisors and ... life—and many students think the same way. As a result, 44% of incoming full-time students average just 12-14 credits per term during their first year, less than the 15 they need to stay on pace for four-year graduation....

I often hear from advisors and administrators the desire to protect their new students from overwhelming themselves with coursework in their first year, especially if it seems like the student would benefit from the chance to adjust to college life—and many students think the same way. As a result, 44% of incoming full-time students average just 12-14 credits per term during their first year, less than the 15 they need to stay on pace for four-year graduation.Analysis of historical records verified that incoming students of all backgrounds and academic achievement levels performed just as well on average when taking a 15 credit course load. Since the “15 to Finish” philosophy is becoming much more widespread, we sought a national analysis to see if the findings from UH held true for other students and schools. We examined data from 1.3 million incoming full-time students representing 137 schools in the Student Success Collaborative and compared outcomes for students who averaged 12-14 credits per term across the first year to those averaging 15 or more.We found that students of every level of high school academic achievement experienced better first-year GPA and retention outcomes when they took more courses. Even students with a high school GPA between 2.0 and 3.0, who averaged at least 15 credits, were two percentage points more likely to persist than their peers that only took 12-14 credits.Using the Pell grant as a proxy for family income, we found that Pell students who took 15+ credits were seven percentage points more likely to persist and had an end-of-year GPA that was 0.12 points higher than their Pell recipient peers who averaged only 12-14 credits per term in the first year.

Credit One Bank has agreed to a $14 million class action lawsuit settlement to resolve claims it violated the federal Telephone Consumer Protection Act (TCPA) by calling consumers with robocalls without their consent.

Credit One Bank has not admitted any wrongdoing but agreed to a $14 million settlement to resolve the TCPA class action lawsuit.The Credit One Bank class action settlement benefits consumers who received an automated call from Credit One Bank or its affiliates between 2014 and 2019 without giving prior consent to be contacted via automated dialing systems or pre-recorded messages.The class action lawsuit claims Credit One Bank violated the TCPA by contacting consumers through automated dialing systems without their prior consent.Credit One Bank is a credit card company based in Paradise, Nevada.

Credit One Bank has agreed to a $14 million settlement following allegations of making thousands of unsolicited robocalls between 2014 and 2019. The settlement addresses violations

While the settlement allows Credit One to avoid admitting wrongdoing, it provides financial compensation to eligible individuals who received unsolicited calls within the specified timeframe. The $14 million settlement fund established by Credit One Bank will cover various expenses before distribution to claimants.To qualify for compensation under the Credit One Bank settlement, individuals must meet specific criteria. First, they must have received an automated or prerecorded robocall from Credit One Bank or its affiliated entities between 2014 and 2019. Second, they must not have provided prior express consent to be contacted through automated systems or prerecorded messages.Finally, they must be able to verify ownership of the phone number that received the calls during the relevant timeframe. Importantly, recipients do not need to have been Credit One customers to qualify, as many calls were allegedly directed to wrong numbers or individuals with no prior relationship to the bank.The claims process for the Credit One Bank settlement will begin once the court grants final approval. Following approval, a dedicated settlement website will launch to manage submissions and provide guidance to potential claimants.

Each credit hour corresponds to a minimum of 3 hours of student engagement per week for a traditional 14-week course or 6 hours per week for a 7-week course.

Wondering how all those credit hours add up? AIC abides by the standard Carnegie Unit to calculate credit hours for all traditional and distance courses.AIC uses the industry-standard Carnegie Unit to define credit hours for both traditional and distance courses.American International College

Assuming that your college has a maximum credit hours per semester of 18, I would say it depends on your workload and the amount of time you're willing to dedicate yourself to do your work. 12 hours is the bare minimum to be considered a "full-time" student at my university and I would say that it's the equivalent of having a full time job depending on the pace you go. For example, I'm a Mechanical Engineering Major (MECE) and I take around 14 ...

Assuming that your college has a maximum credit hours per semester of 18, I would say it depends on your workload and the amount of time you're willing to dedicate yourself to do your work. 12 hours is the bare minimum to be considered a "full-time" student at my university and I would say that it's the equivalent of having a full time job depending on the pace you go. For example, I'm a Mechanical Engineering Major (MECE) and I take around 14 to 16 credit hours a semester and I study probably about 25-30 hours a week on material and its pretty difficult but I got used to the workload.I think 15 credits is the way to go if it lets you graduate on time. Good luck :) ... I took 15, but classes were relatively easy, so it depends on the class. ... I normally take anywhere from 14-17 credits each semester. I had to take atleast 15 credits each semester because of the scholarship that i have says that I need to take 15 credits each semester to be eligible for it.I've had some punishing 4 credit computer science and German classes and some easy af 4 credit introduction courses. Utilize ratemyprofessor and speak with your peers to get an idea of the difficulty of a course and the subject. ... I usually take 15 in a normal semester. The upcoming and most recent one, I'm taking 14 and took 13.I’m currently taking 14, over four classes. But I’m definitely going to have to kick that up closer to 20 at the start of my sophomore year if I continue down the pre-medicine path. Pre-med is more demanding class wise than others, but 15 is typically about normal for most full time students. ... Eh, it depends on the cutoff for full time. 15-16 is my max. ... I never took less than 18 and was at 21 for a semester or two due to TAing. Some of those credits included labs.

My situation is a bit complicated. I'm currently in my third year of college. Last year, I had to withdraw from the fall semester due to various…

If I decide to drop a class, it would be one of the three credit agriculture courses, but I feel like with every class I don't take I get more and more behind. I'm super confused, and would love a bit of advice! Share ... Have you planned out your classes? Before you decide that you're behind, you should map out your classes and see if you can still finish on time with 14 units a semester.You're absolutely right and I honestly needed to read this; there are summer courses to take and other ways to get credits too that stressing over an entire semester should not be an answer. ... It depends on your course load, remember not to over work yourself. ... It depends on the class load. My advisor suggested 14 credit hours after my major transfer, but I decided to take 18 so I wouldn't be behind.I know I'm not the one who asked the question but currently I find myself dropping a class to go from 17 credits to 14 as well.I came in with 21 credits, rarely took over 14 credits a semester, and I'm on track to graduate with two minors in 4 years.

Dd is in the process of signing up for her fall classes. She will be a freshman. From the beginning, she has been planning to major in biology. She wants to do something involving wildlife or environment conservation. I think she has been leaning towards graduate school in zoology/biology/etc. On...

https://forums.welltrainedmind.com/topic/556564-college-freshman-14-vs-17-credits/ More sharing options... Followers 1 · Reply to this topic · Start new topic · You can post now and register later. If you have an account, sign in now to post with your account.https://forums.welltrainedmind.com/topic/556564-college-freshman-14-vs-17-credits/ More sharing options... Followers 1 · Go to topic listing · × · Existing user? Sign In · Sign Up · Back · Homepage · Leaderboard · Board Rules · Events · Forums · Clubs · Back ·

(1) all charges payable directly or indirectly by the buyer and imposed directly or indirectly by the seller as an incident to the extension of credit, including any of the following types of charges which are applicable: time price differential, service, carrying or other charge, however ...

14A OK Stat § 14A-2-109. Definition: (2014) What's This? "Credit service charge" means a finance charge composed of the sum of ·(1) all charges payable directly or indirectly by the buyer and imposed directly or indirectly by the seller as an incident to the extension of credit, including any of the following types of charges which are applicable: time price differential, service, carrying or other charge, however denominated, premium or other charge for any guarantee or insurance protecting the seller against the buyer's default or other credit loss; and(2) charges incurred for investigating the collateral or credit worthiness of the buyer or for commissions or brokerage for obtaining the credit, irrespective of the person to whom the charges are paid or payable, unless the seller had no notice of the charges when the credit was granted.

Yes, Error Code 14 will likely occur if the card number provided is incorrect, incomplete, or improperly formatted. The payment gateway needs accurate information to validate the card, and any discrepancies will result in an error. ... Ready for the ultimate credit card processing experience?

Error Code 14 typically signifies an “Invalid Card Number” error, and it is commonly encountered during online transactions, especially when making purchases using credit or debit cards.While using a card if you enter an invalid card number it generates error code 14. Let us understand more about error code 14, its significance and how to fixThere are several reasons behind this occurrence, such as mistyping the card number, using an expired card, or failing to input all the necessary digits. Additionally, certain security measures, like address verification or card validation codes, could also contribute to triggering Error Code 14 if the information provided does not match the card issuer’s records.When dealing with online transactions, encountering Error Code 14, also known as the “Invalid Card Number” error, can be a frustrating experience for both customers and merchants. This error message indicates that the card number provided during the payment process is invalid or cannot be verified by the payment gateway.

Read Section 14 Credit-Token Agreements of Consumer Credit Act 1974 C39. Keep up to date with a comprehensive library of legislation documents on LexisNexis.

You can contact the three major credit bureaus—Equifax®, Experian® and TransUnion®—to check your child’s credit and dispute any errors. According to Experian, they can check for themselves once they turn 14.

Learn how teenagers can start establishing credit as part of a strong financial foundation.As a parent, you always want to make sure your kids are on the path to a bright future—at work, at home and in life. Learning how to build credit can be part of that. Good credit scores can give young adults access to good rates and terms on credit.You know your teen best, so you can decide what’s appropriate for them. But here are some credit tips you might use to help teach your teen about the benefits of building a strong credit history and developing smart financial skills.Learn more about how to help your teen establish credit and practice responsible financial habits.